Guide

There are only 3 days until August, and after a wave of adjustments last week, DMC still did not hold on, and the transaction price once fell below the 13,000 mark. However, compared with the decline of silicon metal, DMC's concessions are still within a controllable range. August has always been the prelude to the stocking of golden September and silver October, if there is still a trace of expectation this year, the probability is counting on golden September and silver October, combined with the current price is basically at the bottom, the international silicone giants have also given up the price war, the price increase letter slammed on, releasing a rebound signal (leading announcement: organic silicon rose in August). From the information feedback we have learned in the past two days, although most of the middle and lower reaches are still bearish on the market outlook, the stocking operation is increasing, and the stocking volume is controlled at about 15-30 days.

At present, in terms of raw materials, silicon metal fluctuates greatly, and it has basically not raised its head in 2024, 421# silicon metal has broken all the way from 16,000 at the beginning of the year, and fell to 12,000+ last week, and nearly 4,000 from January to July! At present, the production cost of most silicon metal enterprises has been impacted, and the production reduction and shutdown may be expected to increase.

During the transition period in July and August this week, costs fell on the one hand; On the one hand, the giants sent a price increase letter; Negative and negative factors are intertwined, and silicone may form a short-term turning point in the volatile trend to maintain stability and explore the rise! Although in the long run, the oversupply will not be resolved, and the downward pressure will continue, but the long downward cycle, how to seize the short-term fluctuations is also more important for many enterprises.

The last three days of July may be a good opportunity for the low-level layout in the third quarter, and can this year's August replicate last year's rebound and accumulate a wave of strength for the Golden Nine peak season? Let's analyze and discuss with us.

Rotational maintenance, operating rate of 70.13%

1 Jiangsu and Zhejiang regions

2 units in Zhejiang are operating normally, and in the trial production of 200,000 tons of new production capacity, 1 partial shutdown and maintenance of some units; Zhangjiagang 400,000 tons of equipment is operating normally;

2 Central China

Hubei and Jiangxi plants maintain negative operation, and new production capacity is being promoted;

3 Shandong region

1 plant with an annual output of 80,000 tons is operating normally; 1 plant with an annual output of 700,000 tons, operating with reduced load; 1 150,000-ton plant long-term shutdown;

4 North China

1 plant in Hebei is operating with reduced load, and the release of new production capacity is slow; 2 installations in Inner Mongolia are operating normally;

5 Southwest China

Yunnan 200,000 tons of plant normal operation;

6 Overall

Last week, the operating rate of monomers was 70.13%, and the weekly output fell. Some monomer manufacturers maintain a state of rotation maintenance to regulate the inventory. At the same time, some of the new production capacity adopts the method of opening new and stopping old to cope with the weak operation of the market.

The cost is small, and the 107 glue and silicone oil are weak and stable

107 rubber market: Last week, the domestic 107 rubber market was stable and the transaction was weak. As of July 28, the domestic 107 rubber market price is 13,500-13,800 yuan/ton. On the cost side, DMC struggled to hold the 13,000 mark during the week, and the continuous decline weakened the cost support for 107 rubber. On the supply side, the main manufacturers in Shandong have become the main force of market supply by virtue of their significant price advantages, and at the same time, the leading enterprises have also maintained price stability, so that large orders are mostly concentrated in these two advantageous enterprises, and the order stability is good.

In addition, monomer units have generally taken measures to reduce production, and the new monomer production capacity has not been effectively formed, which has not caused inventory pressure on the 107 rubber market. Other small and medium-sized manufacturers lack advantages, and most of them just need to be traded at the open price. With the downward shift of the cost center of gravity this week, the willingness of downstream buyers to purchase at low prices has increased, and the activity of market inquiries has also increased.

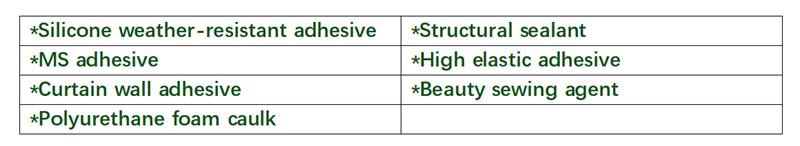

Silicone adhesive demand side: construction adhesive market: the recent performance is poor, and the load of terminal enterprises is generally stable. At the end of the month, the procurement process of 107 rubber in the construction rubber industry is relatively slow, which is not only affected by the weak price of DMC, but also due to the lack of confidence in the market in the release of traditional off-season demand, resulting in the consumption of construction rubber to maintain the rigid demand level in the off-season. Macro level: The Third Plenum of the CPC Central Committee clarified the path of real estate reform, and the government aims to build a new model of real estate development through a combination of financial, land and stock housing digestion policies, which is expected to gradually release the demand for housing purchases, reduce the housing burden of residents, and inject confidence into the real estate market, and the building sealant market is expected to improve.

In terms of photovoltaic adhesives, manufacturers that have deployed distributed modules on a large scale in the early stage may adopt a low-price shipping strategy, resulting in a downward shift in the overall price center of the distributed photovoltaic market. However, the construction activities of domestic ground power stations have shown signs of recovery, some large-scale base projects have started one after another, and early orders are expected to be delivered one after another, which will have a certain positive impact on the digestion of photovoltaic adhesive.

At present, the price center of gravity of the domestic 107 rubber market is stable. The comprehensive support of upstream raw materials is loose, and short-term profits are difficult to appear, and the consumption pattern in August may improve limitedly. To sum up, it is expected that this week's 107 rubber market may be weak.

Silicone oil market: The domestic silicone oil market remained stable last week. As of July 28, the domestic silicone oil market price was 14,700-15,500 yuan/ton. In terms of cost, DMC fell in a narrow range, stimulating some silicone oil companies to stock up. In addition, the other main material, silicon ether, due to the decline in the price of raw material three has not been effectively transmitted to the silicon ether market, silicon ether manufacturers due to limited profit margins, the operating rate remains low, and the sentiment of reluctance to sell is still strong. Although the offer is relatively firm, the price of silicon ether has a downward trend due to the lack of support from silicone oil manufacturers and the weak cost side.

On the supply side, as silicon-ether remains high, silicone oil manufacturers are slow to pass on costs, and profit margins are low, resulting in replenishment operations around rigid demand. At the same time, orders in the off-season are unstable, and local silicone oil manufacturers have reduced production to deal with it, and the quotation has limited room for downward adjustment. In addition, this week, as the demand for large households to stock up before the peak season approaches, the negotiation space is expected to gradually expand with the downward movement of costs.

In terms of foreign brand silicone oil, although the domestic silicone market as a whole is weak, international giants have announced price increases, resulting in a good mix of empty markets and agents continuing to maintain stable shipments for the time being. As of July 28, foreign brand silicone oil agents quoted 18,000-18,500 yuan/ton.

On the demand side, the recent consumption of silicone oil has taken on a weak pattern in the early stage, and the main logic is biased towards maintaining production and digesting inventories. In terms of room temperature glue, the consumption rate is slow, the market transaction confidence is insufficient, and the manufacturers are not active in order stocking, resulting in the scarcity of new silicone oil orders and a depressed market atmosphere. In the field of printing and dyeing and daily chemicals, the terminal textile market is in the in-depth stage of the off-season, with a lack of orders and significant inventory pressure. Although the atmosphere of order inquiry in autumn and winter has heated up, the actual progress of orders is slow, and the willingness to stock up is weak.

To sum up, the current fundamental bearish expectations of the silicone oil market still exist. The impact of the traditional off-season has led to sluggish market sentiment, continued weak costs, and downstream demand is still in a wait-and-see state, which needs time to accumulate and release. At the same time, there has not yet been a new growth point on the demand side. Therefore, it is expected that silicone oil prices will continue to maintain a stable and weak operation trend in the short term.

High elasticity, high modulus, transparency, high stability

Waste silica gel fell by 200, and pyrolytic material shipments were differentiated

Pyrolytic material market: last week, the price of new materials was reduced, and the downstream low-level layout increased, but this is more and more at a disadvantage for the cracking material market, under the triple pressure of new material prices and costs and profits, pyrolytic material enterprises have no power to resist in terms of bidding, and can only continue to operate in a low-key manner, and some companies have even started to reduce production, at present, the pyrolytic material DMC price is 12000~12500 yuan/ton (excluding tax), and the pyrolytic silicone oil is reported at 13000-13800 yuan/ton (excluding tax cash price), Due to its good financial strength and stable quality, the large-scale pyrolysis plant can reach a part of the account period orders with the downstream large households, and the price is slightly higher than the market of about 300, so as to ensure the normal operation of production.

In terms of waste silica gel, the new material declined, and the waste silica gel recyclers were also difficult to raise the price, and the raw edge receipt price was reported at 4000~4300 yuan/ton (excluding tax) last week, a slight drop of 200! However, the rough edge of the 4000 mark, silicon product factories are not willing to produce more, and the hoarding behavior continues. In the case that the pyrolytic material enterprises themselves are difficult to protect, they resist the purchase of burrs that exceed the cost of new materials, so the waste silica gel recyclers are in a dilemma.

As the saying goes, "the lips are cold and the teeth die", the pyrolysis material is difficult to ship, and how can the waste silica gel achieve a unilateral rise? It is expected that the pyrolysis plant and waste silica gel plant will continue to operate weakly in the short term.

Raw rubber is partially profitable, and rubber compound is operated under pressure

Raw rubber market: Last week, the main manufacturers still maintained the price of raw rubber at 14,300 yuan/ton, which was stable, and the actual transaction AB class and 3+1 preferential policies were parallel, forming a comprehensive suppression of other raw rubber enterprises. However, under the loosening of raw material DMC, other monomer factories also have signs of synchronous concessions on raw rubber, and take the initiative to adjust the offer to 14,000~14,300 yuan/ton, and the secret concession still exists. In terms of orders, due to the decline in the price of some raw rubber, the arrival time is also fast, and some rubber compounding enterprises with the need to replenish the warehouse have stocked, but because the price is still suppressed by the main manufacturers, the sentiment of hoarding raw rubber in the case of insufficient orders is general, and a small amount of replenishment is mainly needed.

On the whole, at present, most monomer factories are still based on DMC, 107 rubber or other downstream product layout, and have no intention of competing with the main manufacturers in the raw rubber market for the time being. In the short term, the bidding atmosphere of raw rubber is not strong, and the main manufacturers are mainly responsible for maintaining stability or declining.

Rubber compounding market: July into the end, the center of gravity of the rubber compound plant visibly shifted to the collection and impulse, the market quotation is basically stable, the current conventional hardness rubber compound price of 13000 ~ 13400 yuan / ton, rubber compounding enterprises at the end of the month generally appear volume operation, the actual transaction has a small bargaining space, conventional product profits are generally severe. In terms of procurement, with more and more A+ customers of the main factory, the cost gap of rubber compounding manufacturers has narrowed significantly, and the basic tasks are mainly completed at the end of the month.

In terms of silicon products, the recent orders for silicon products have been sustained well and the production is stable. Xiaobian also noticed that under the extreme involution, many silicon product manufacturers began to develop short video directions this year, actively promoting their own products and deepening the public's understanding of the silicone industry. In addition, the recent reform of the power system has a certain driving effect on the silicone industry.

On the whole, the rubber compound has basically completed the procurement task before the end of the month, the mentality is relatively peaceful, and the collection and shipment are the key.

Market

To sum up, the DMC market showed a trend of stopping and stabilizing last week. Although the demand side is still in the off-season of consumption, the price of DMC has hit the low point of the year, and some manufacturers have achieved certain results through the strategy of exchanging price for volume, and the atmosphere of market bottoming has gradually increased.

On the cost side, as of July 26, the market price of 421# industrial silicon was 12,000-13,000 yuan/ton, a weekly decline of 3.85%. For silicone monomers, this trend means lower costs and higher production margins, but it also adds to the bearish mentality in the downstream market. Subsequently, silicon metal manufacturers are facing losses while registering warehouse receipts to accumulate again, showing that the market has limited strength to undertake spot sales, further exacerbating the expectation of silicon factories to stop and reduce production.

On the supply side, there will be new production capacity on the market in August, in view of the launch of new production capacity in the first half of the year, it is expected that the growth of the supply side in August will be limited, and the current profit is meager, and the expectation of local opening and stopping the old is also large. Last week, under the simultaneous stimulation of the low level and the price increase letter, some large factories appeared to buy the bottom and build positions, and the single factory received orders last week to digest the recent inventory, and it is expected that the willingness to stop falling and stabilize this week will increase.

On the demand side, the transaction performance of the downstream market did not meet expectations, and the accumulation of finished product inventory led to tight cash flow, and it was difficult for the demand market to be significantly boosted in the short term. In addition, the boost effect of the real estate industry has gradually evolved into a long wait, and the demand increment of room temperature glue " Golden September and Silver October " remains to be seen. At the same time, the activity of the high-temperature glue market last week was average. Therefore, the bottom-buying and opening of positions by local large factories cannot complete the determination of the rebound, and it is necessary to observe the stocking rhythm in the middle and lower reaches of this week.

Looking back at the third quarter of last year, it was also the lowest price of the year in July, this year standing in the same scenario, after a wave of dark falls last week, basically touched the downstream expected low price, superimposed golden September and silver October as the most anticipated demand release point in the second half of the year, all parties unanimously promoted, some of the middle and downstream enterprises or have the psychology of early storage, single factories or can seize the opportunity to take a wave of orders, ushered in a short respite period, for August or can be a little look forward to it. (The above analysis is for reference only, for communication purposes, and does not constitute a recommendation to buy or sell the commodities involved)

From July 22nd to 28th, the mainstream quotation of silicone market:

Silicone DMC

New material: 13000-13900 yuan/ton (water purification tax included)

Pyrolysis: 12000-12500 yuan/ton (excluding tax)

Silicone D4

14000-14500 yuan/ton (water purification tax included)

107 Silicone Rubber (Conventional Viscosity):

New material: 13500-13800 yuan/ton (water purification tax included)

Dimethicone (conventional viscosity):

Domestic: 14700-15500 yuan/ton (including packaging including tax)

Import: 18,000-18,500 yuan/ton (including tax and packaging)

Pyrolysis: 13000-13800 yuan/ton (excluding tax)

Raw rubber (molecular weight 450,000-600,000):

14000-14300 yuan/ton (including tax and packaging)

Precipitated rubber compound (conventional hardness):

13000-13400 yuan/ton (including tax and packaging)

Waste silicone (waste silicone burr):

4000-4300 yuan/ton (excluding tax)

Domestic fumed silica (200 specific surface area):

Low end: 18,000-22,000 yuan/ton (including tax and packaging)

High-end: 24000-27000 yuan/ton (including tax and packaging)

Precipitated silica for silicone rubber:

6300-7000 yuan/ton (including tax and packaging)

(The transaction price is high or low, you need to confirm with the manufacturer's inquiry, the above price is for reference only, not to make any transaction basis)

Some product information:

Dimethicone (low to medium viscosity): 5-10-20-50-100-350-500-1000 CST

Dimethicone (high viscosity): 5000-10000-12500-60000-100000-300000-500000 CST

Hydrogen-containing silicone oil at the end

Hydrogen-containing silicone oil at the low ring end

End epoxy silicone oil

Alkaline epoxy silicone oil

Polyether epoxy silicone oil

Amino silicone oil

Low-ring amino silicone oil

Low yellowing amino silicone oil

Modified amino silicone oil

Side-chain low-hydrogen silicone oil

Vinyl silicone oil (medium viscosity): 350-500-1000-1500-3500 CST

Vinyl silicone oil (high viscosity): 7000-14000-20000-60000-100000 CST

Special silicone oil emulsions

Modified carboxyl silicone oi

Other silicone products: Linear body, 107 glue, DMC, D4, crosslinker, coupling agent, silicone, etc.

Hydroxyl silicone oil, end vinyl silicone oil

Dimethicone oil

Room temperature vulcanized methyl silicone rubber

Phenyl silicone oil

Amino silicone oil

Silicone emulsion (suitable for daily chemical, textile, chemical fiber, polishing, demolding, lubrication and other industries)

Additive liquid silicone rubber (mold, button, pacifier, electricity, coating, kitchenware, etc.)

Imported Octamethyl cyclotetrasiloxane (D4)

Mixed silicone oil (daily chemical)

Fluorosilicone oil series

Methyl fluorosilicone, vinyl fluorosilicone, polyvinyl fluorosilicone, hydrofluorosilicone, hydroxyfluorosilicone

Modified silicone oil series

Alkyl (aryl) modified silicone oils, alcohol-based modified silicone oils, single-ended (vinyl/hydroxyl/trimethoxy) modified silicone oils

Hydroxy silicone oil (high/low hydroxyl number), (high) vinyl hydroxyl silicone oil, fluorinated structural control agent

High-purity silicone oil series

Phenyl silicone oil, electronic grade silicone oil, cosmetic grade silicone oil, food grade silicone oil, industrial grade silicone oil

Post time: Jul-29-2024